Making Tax Digital Rules Will KILL Buy-to-Let Property Market For Small Landlords

895 View

Share this Video

- Publish Date:

- January 10, 2023

- Category:

- Commercial Real Estate

- Video License

- Standard License

- Imported From:

- Youtube

Tags

Check out my new training to help you get control of your finances in 28 days! Click to join: https://bit.ly/3isugCr

New HMRC Making Tax Digital Rules (MTD) will make life MUCH harder and more costly for small buy-to-let landlords, adding further red tape to the misery of increased legislation and higher interest rates.

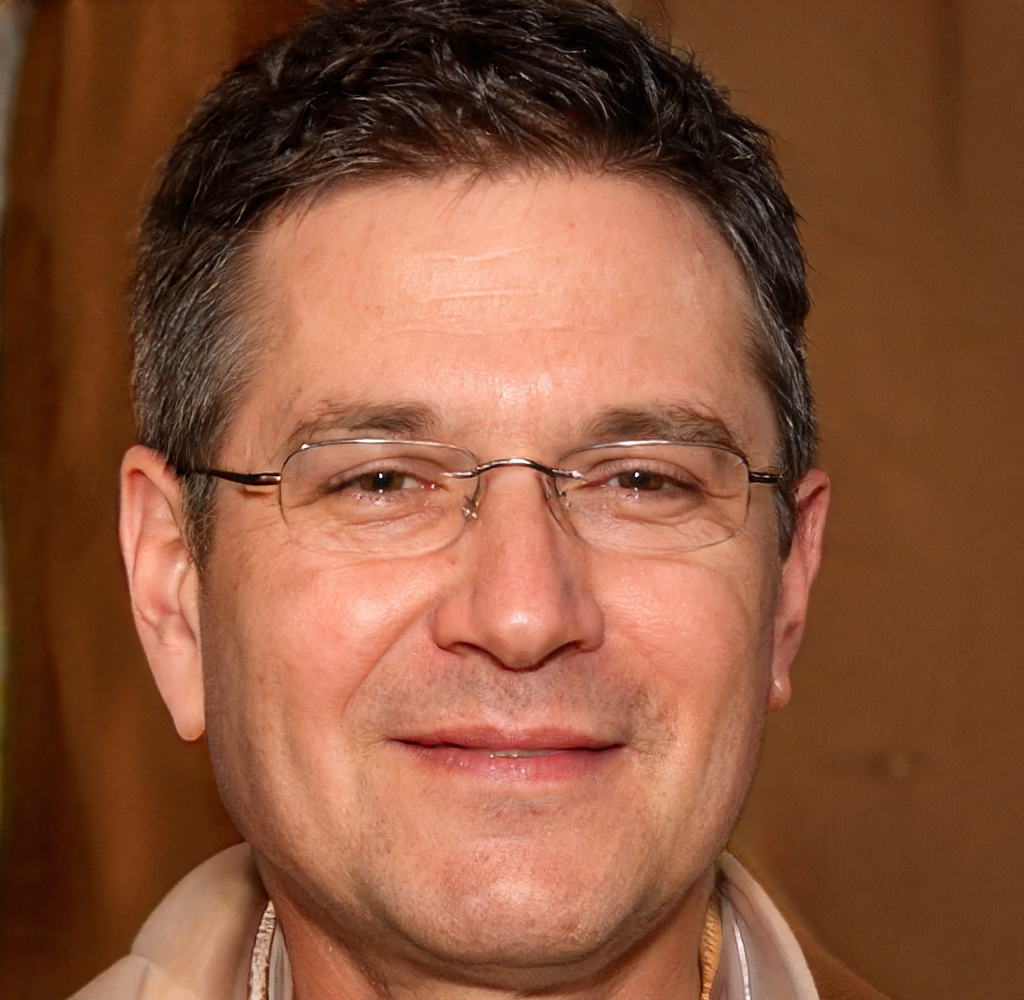

Interview with Tax Consultant James Cannaford of Hawthorne Tax Consultancy who covers:

• How MTD will ne a nightmare for smaller landlords, not companies and partnerships.

• How Jeremy Hunt’s Autumn budget statement will affect buy-to-let landlords.

• Increased legislation and higher commercial interest rates.

• Capital Gains Tax changes.

• Corporation Tax changes.

• AIRBNB HMRC deal.

To reach James Cannaford

Website: www.hawthorneconsultancy.com

Email: [email protected]

Phone: 01442 97 44 99

LinkedIn: https://uk.linkedin.com/in/james-cannaford-621527195

Get your own finances in order and learn how to manage your money and increase your wealth.

Check out my new training to help you get control of your finances in 28 days!

Click: https://bit.ly/3isugCr

#tax #property #capitalgainstax #finance #financialfreedom #freefinancialtraining #freetraining #money #wealth #landlord #buytoletlandlord #propertyinvestment #makingtaxdigital

Did you miss our previous article...

https://trendinginrealestate.com/commercial-real-estate/if-i-had-to-start-over-in-real-estate-in-2022-heres-what-id-do