How to Use Delaware Statutory Trusts in a 1031 Exchange

28 View

Share this Video

- Publish Date:

- November 16, 2022

- Category:

- Home Remodeling Trends

- Video License

- Standard License

- Imported From:

- Youtube

Tags

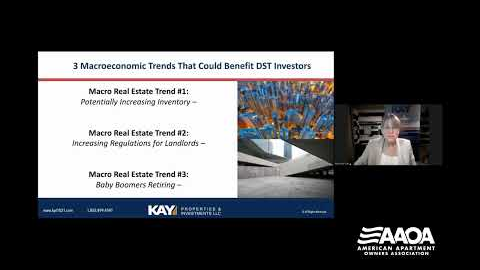

Delaware Statutory Trusts (DSTs) are becoming increasingly popular not only for a 1031 exchange but also for landlords who want to become passive investors. And there are 3 macroeconomic trends that have made it the best time to invest in DSTs.

In this 60-minute webinar Betty Friant, Senior Vice President at Kay Properties, covers:

- How DST investments work (whether you’re doing a 1031 exchange or not)

- Whether a DST is a good investment strategy for you

- 3 macroeconomic trends that could benefit DST investors

- How to use DSTs as an estate planning tool

About the Speaker:

Betty Friant oversees the Kay Properties and Investments, LLC Washington, D.C. office. With an extensive background in commercial real estate and expertise in investment sales, Betty specializes in 1031 Tax-Deferred Exchange clients and high net worth investors. Betty is well versed in the many aspects of commercial real estate and has extensive market knowledge. She holds the coveted CCIM designation, which recognizes expertise in commercial and investment real estate.

With more than 35 years of real estate industry experience, Betty has focused on the acquisition and disposition of single-tenant NNN properties. She is driven by her passion for identifying clients’ needs, goals, and objectives thereby helping to identify the best opportunities for them.

Did you miss our previous article...

https://trendinginrealestate.com/home-remodeling-trends/how-to-make-money-with-real-estate-investment-trust