2023 Q3 Market Report + Office Hours

328 View

Share this Video

- Publish Date:

- November 9, 2023

- Category:

- MultiFamily Investing

- Video License

- Standard License

- Imported From:

- Youtube

Tags

Join the Hui Deal Pipeline Club and secure a personal one-on-one call with Lane!

https://thewealthelevator.com/club

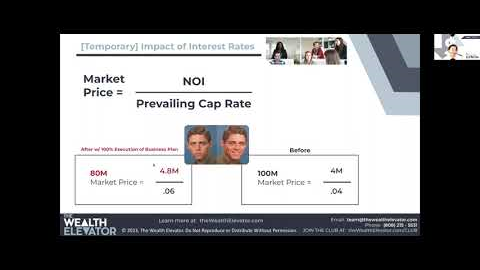

The 2023 third quarter market update reveals a drastic shift in commercial real estate due to unprecedented interest rate hikes since summer 2022, described as a Black Swan event. The market has dropped roughly 20%, buyer activity has decreased significantly, and loan-to-value ratios have fallen from 70% to 50-55%, making purchases and refinancing more challenging. Cap rates have also risen, affecting property values. Additionally, there's been a notable increase in expenses like insurance and taxes post-pandemic. The forecast includes potential federal interventions, a focus on newer housing demands, and a pivot towards development projects to counteract the volatility. Overall, there's an emphasis on long-term investment stability despite short-term market turbulence.

[00:33] Interest Rate Hikes & Real Estate Effects

[00:55] Historic Interest Rates Surge

[01:20] Commercial Real Estate Market Drop

[01:37] Buyer Activity Decline

[03:05] Future Interest Rate Predictions

[04:12] Real Estate Valuation Equation

[05:20] Cap Rate Effect on Property Value

[08:09] Loan Refinance Challenges

[09:27] Fixed Rate Debt Strategies

[11:11] Rent Decline & Apartment Construction

[12:24] Supply and Demand in Housing Market

[13:30] Federal Interest Rate Strategy

[14:40] Real Estate Debt Concerns

[16:32] Investment Decision Making

[18:21] Institutional Impact & Diversification

[20:10] Economic Strengths & Weaknesses

[22:16] Home Ownership Trends & Government Spending

[23:09] Real Estate Market Threats & Loan Maturities

[26:21] Understanding Market Threats: Asset Prices & Buyer Equilibrium

[26:40] Federal Rates Impact: Timing the Market's Tides

[27:16] Global Tensions & Real Estate: Managing Investment Threats

[28:49] The Long Game: Investing in 2023 for Future Wealth

[29:12] 2023 Investment Strategies: Navigating Rate Hikes and Market Shifts

[30:10] Strategic Acquisitions: Using Pessimism to Your Advantage

[31:15] Passive Activity Losses: Investing in ATM Equipment for Tax Benefits

[32:28] Capital Placement: The Key to Building Wealth

Connect with me:

LinkedIn: https://www.linkedin.com/in/lanekawaoka/

Facebook: https://www.facebook.com/TheWealthElevator

Instagram: https://www.instagram.com/TheWealthElevator

Lane Kawaoka is a multi-family syndicator who owns 10,000+ rental units and is the leader of “Hui Deal Pipeline Club” which has acquired over $2.1 Billion AUM of real estate by syndicating over $186 Million Dollars of private equity since 2016.

Lane uses his Engineering degree to reverse engineer the wealth building strategies that the rich use in the Top-50 Investing Podcast, The Wealth Elevator.

Did you miss our previous article...

https://trendinginrealestate.com/multifamily-investing/zillow-americans-dont-want-to-buy-homes