Phase 2 Of The Housing Crash Begins (Builders Panic)

102,405 View

Share this Video

- Publish Date:

- January 30, 2023

- Category:

- MultiFamily Investing

- Video License

- Standard License

- Imported From:

- Youtube

Skip the waitlist and invest in blue-chip art for the very first time by signing up for Masterworks:

https://www.masterworks.art/mhfin

Purchase shares in great masterpieces from artists like Pablo Picasso, Banksy, Andy Warhol, and more! 🎨

See important Masterworks disclosures:

https://www.masterworks.com/about/disclaimer?utm_source=mhfin&utm_medium=youtube&utm_campaign=1-24-23&utm_term=MHFIN+Viewer&utm_content=mhfin

EPB Research Channel

https://www.youtube.com/@EPBResearch

Bill McBride Substack

https://www.calculatedriskblog.com

Reventure Consulting Twitter (Nick Gerli)

https://twitter.com/nickgerli1/status/1615471141530861568

My Twitter

https://twitter.com/LorenzoBatarilo

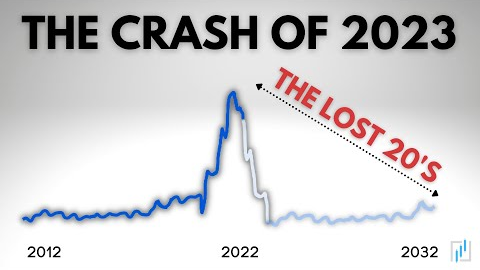

The 2023 housing market crash is getting much worse. While prices today are down a minuscule 2.35% on average, the future of the market is looking grim with reliable indicators flashing red suggesting that a massive storm is coming, one that will rival the Great Financial Crisis of 2007. But what exactly is this clear evidence that is indicating such a troubling situation within the real estate sector? Well, we know from other researchers and experts that real estate values tend to follow volume and inventory. Now without making this video a boring economics lesson let's just simplify this theory with this. Real estate is no different than any other market on earth. At its core, it comes down to the simple relationship between supply and demand. So what does this look like in real life?

Did you miss our previous article...

https://trendinginrealestate.com/multifamily-investing/michael-saylor-why-60k-bitcoin-next-week-bitcoin-urgent-news-btceth-price-prediction