The Damage Will Be Incalculable...

86,598 View

Share this Video

- Publish Date:

- June 4, 2024

- Category:

- Real Estate Trends

- Video License

- Standard License

- Imported From:

- Youtube

Tags

⚠️⚠️ Subscribing to our website gives you ACCESS to: ⚠️⚠️

- All our current ACTIVE trade ideas

- Trade alerts on any adjustments and NEW trades

- Our short-medium-long term outlooks on the stock market (3 episodes a week)

- Emergency updates on timely market opportunities

- A TON of education on how to become a profitable trader and investor

🚨 20% DISCOUNT to Access our Service at https://bit.ly/3RbBhJp (EXPIRING June 3, 2024 at 11:59pm ET)

See our 2024 track record at https://bit.ly/4dZI42W

🐦 Follow GOT on 𝕏:

https://twitter.com/gameoftrades_

🐦 Follow Peter on 𝕏:

https://twitter.com/PeterMassaut

🔵 Follow GOT on Linkedin:

https://www.linkedin.com/company/game-of-trades/

🔵 Follow Peter on Linkedin:

https://www.linkedin.com/in/peter-massaut-949b20213

📹 Want to produce videos just like this? Reach out to [email protected]

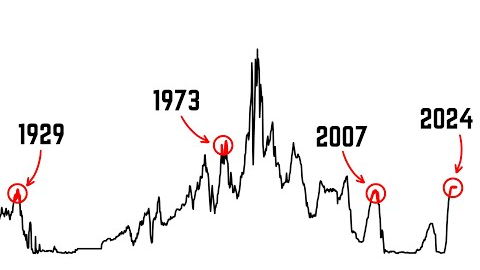

In this video, we delve into the recent increase in initial jobless claims and the drop in the economic surprise index, leading to recession fears and market volatility since March 2024. Contrary to popular belief, the recent S&P 500 correction was due to rising interest rates, not recession concerns. We discuss how shifts in interest rate expectations impacted the market and highlight the significance of technical indicators and the OEX open interest ratio.

DISCLAIMER: This video is for entertainment purposes only. We are not financial advisers, and you should do your own research and go through your own thought process before investing in a position. Trading is risky; best of luck!

Did you miss our previous article...

https://trendinginrealestate.com/real-estate-trends/banking-sector-hiding-trillions-of-dollars-in-troubled-assets