Fund Friday E36: Wealth Beyond TV and Transitioning to Real Estate Investing with Chris Collins

22 View

Share this Video

- Publish Date:

- July 20, 2024

- Category:

- Where to Buy

- Video License

- Standard License

- Imported From:

- Youtube

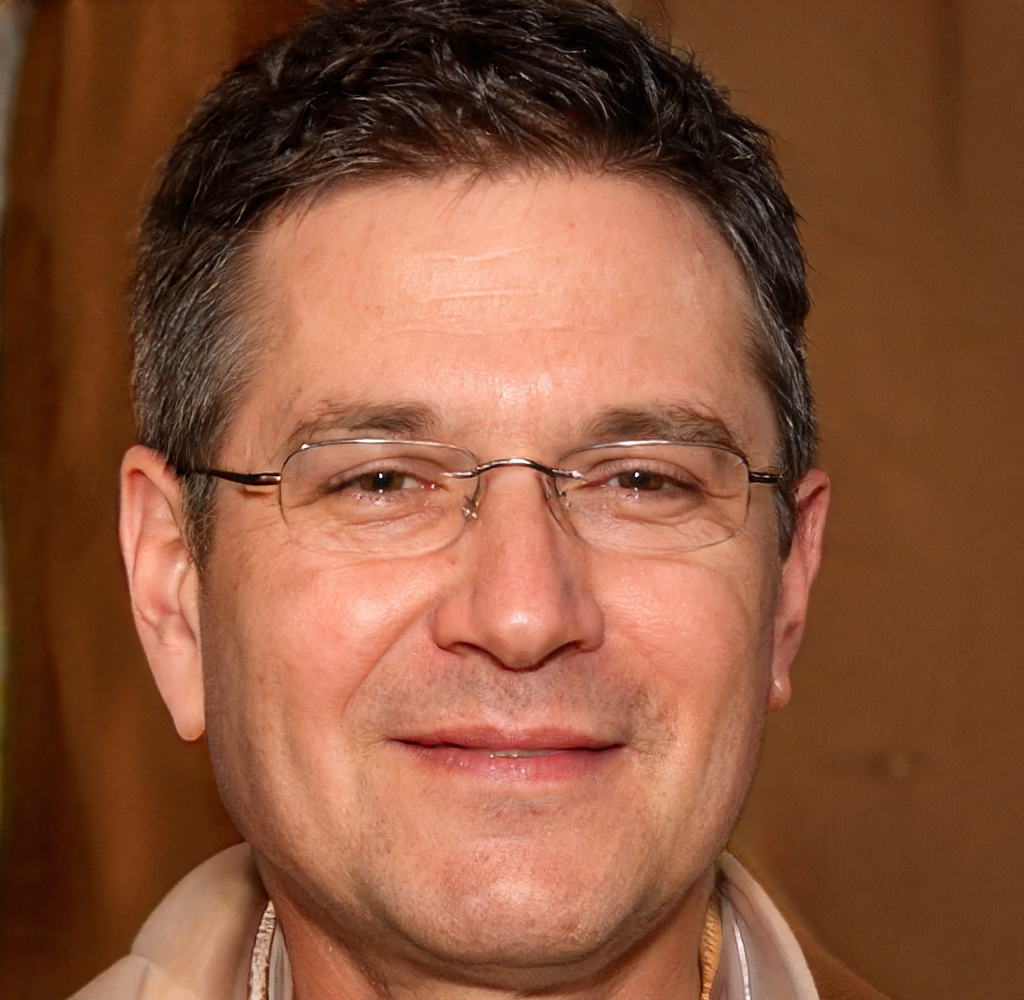

Join us in this episode of Fund Friday as we welcome Chris Collins, managing partner of Amity Cashflow! He shares his incredible journey from a Hollywood editor for shows like Shark Week and America's Next Top Model to a successful real estate investor.

Learn how Chris transitioned from single-family homes to multifamily syndication, the importance of expert partnerships, and key investment strategies for value-add multifamily properties. Gain insights into loan terms, the role of debt, and Chris's guide for passive investors.

Don’t miss this chance to learn from one of the best in the business!

Rob oversees acquisitions and capital markets for Lone Star Capital and has acquired over $600M of multifamily real estate. He has evaluated thousands of opportunities using proprietary underwriting models and published the number one book on multifamily underwriting, The Definitive Guide to Underwriting Multifamily Acquisitions. He has written over 50 articles about underwriting, deal structures, and capital markets and hosts the Capital Spotlight podcast, which is focused on interviewing institutional investors.

👉 Learn more at www.lscre.com

👉 To apply to attend LSC Summit 2024: www.lscsummit.com

👉 Grab a copy of Structuring And Raising Debt & Equity For Real Estate at https://www.structuringandraising.com

▪︎ Get a FREE copy of the Passive Investor Guide:

https://www.lscre.com/content/passive-investor-guide

▪︎ Subscribe to our newsletter and receive our FREE underwriting model package:

https://www.lscre.com/resource/underwriting-model

▪︎ Follow Rob Beardsley:

https://www.linkedin.com/in/rob-beardsley/

https://www.facebook.com/RobBeardsleyLSC/

▪︎ Read Rob’s articles:

https://www.lscre.com/blog

With over $600 million in acquisitions and over 30% gross realized returns since 2018, Lone Star Capital is a fast-growing real estate investment firm owning and operating over 4,500 multifamily units in Texas. We deliver superior risk-adjusted returns through diligent sourcing and selection, vertically integrated property management, and rigorous reporting.

Timestamps:

00:00:00 - Introduction

00:02:06 - Transitioning from the TV industry to real estate for financial stability

00:04:27 - Transitioning from Reality TV to Real Estate

00:06:29 - From Single Family Homes to Multifamily Syndication

00:08:52 - Cash Flow Solutions in Real Estate Investment

00:10:56 - Dealing with the Challenges of Property Management

00:12:52 - The Importance of Streamlined Processes and Mind Share

00:14:47 - The Difference Between Investing and Wishing

00:16:41 - Lessons learned from my first real estate investment

00:18:45 - Transition to Apartments

00:20:50 - Transition to Apartment Syndication

00:22:54 - Focus on Multifamily Business

00:25:07 - Investing in Different Markets

00:27:20 - Investing in Different Markets

00:29:18 - Cash Flow vs Equity Multiple in Multifamily Investing

00:31:30 - Investing in Value-Add Properties for Wealth Growth

00:33:43 - Evaluating Door Prices

00:35:41 - Investing in real estate: A guide to passive investing

00:37:48 - Investor expectations and underwriting analysis

00:39:49 - Understanding Loans and Tracking Investments

00:42:07 - Assessing Risk and Opportunities

00:43:59 - Risks of Investing in Multifamily

00:46:06 - Using Bridge Debt for a Property Investment

00:48:13 - Learn More about the Business