Denver Real Estate Market Update - December 1, 2022

54 View

Share this Video

- Publish Date:

- December 28, 2022

- Category:

- Real Estate Trends

- Video License

- Standard License

- Imported From:

- Youtube

Tags

Thanksgiving Weekend Lull

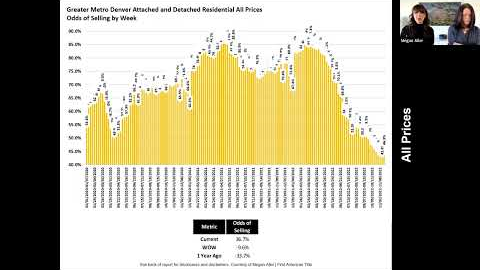

Thanksgiving represents one of the slowest weeks of the year for purchase activity in Metro Denver each year and this year was no exception. Pending transactions fell by -35.9% from the week prior with only 489 total units going under contract over Thanksgiving weekend. While we did see a dip in active units, with the demand side drop of fewer units going under contract it popped our supply in months up from 2.0 months of inventory up to 3.0 months of inventory for this last weekend. Keep in mind there is typically a pop of activity the weekend before and after a holiday weekend so this number should come down this weekend as buyers circle back post-holiday weekend. Hopefully back down the 2.0 month range.

Showings are also a great gauge on market activity, and we only set 5,976 total showings in the week of the 23rd-29th which was down by 39.1% from the prior week. Listings should have seen about 1 showing last week if they were for sale during this period. Again, there is typically a pop of activity the weekend before and after a holiday weekend, so we'll be monitoring showings closely to see if there is a rebound. Shows to contract were 12 this last week and median days on market grew to the highest number we've measured since January of 2014 at 32 median days on market. Median days on market tends to grow through the end of December.

Credits

Megan Aller

Account Executive

First American Title Insurance Company

(720) 229 - 6641

[email protected]

Nicole Rueth

Branch Manager

Fairway Independent Mortgage Corporation

(303) 214 - 6393

[email protected]

Be sure to check out my other platforms.

My Facebook: https://www.facebook.com/VicMerchantKW

My Instagram: https://www.instagram.com/victoriamer...

My Website: https://victoriamerchant.com/

My Blog: https://victoriamerchant.com/blog

My Link Tree: https://linktr.ee/VictoriaMerchant

Properly Valuation: https://victoriamerchant.com/home-valuation

Did you miss our previous article...

https://trendinginrealestate.com/real-estate-trends/10-best-real-estate-stocks-to-buy-in-2023-best-reit-stocks